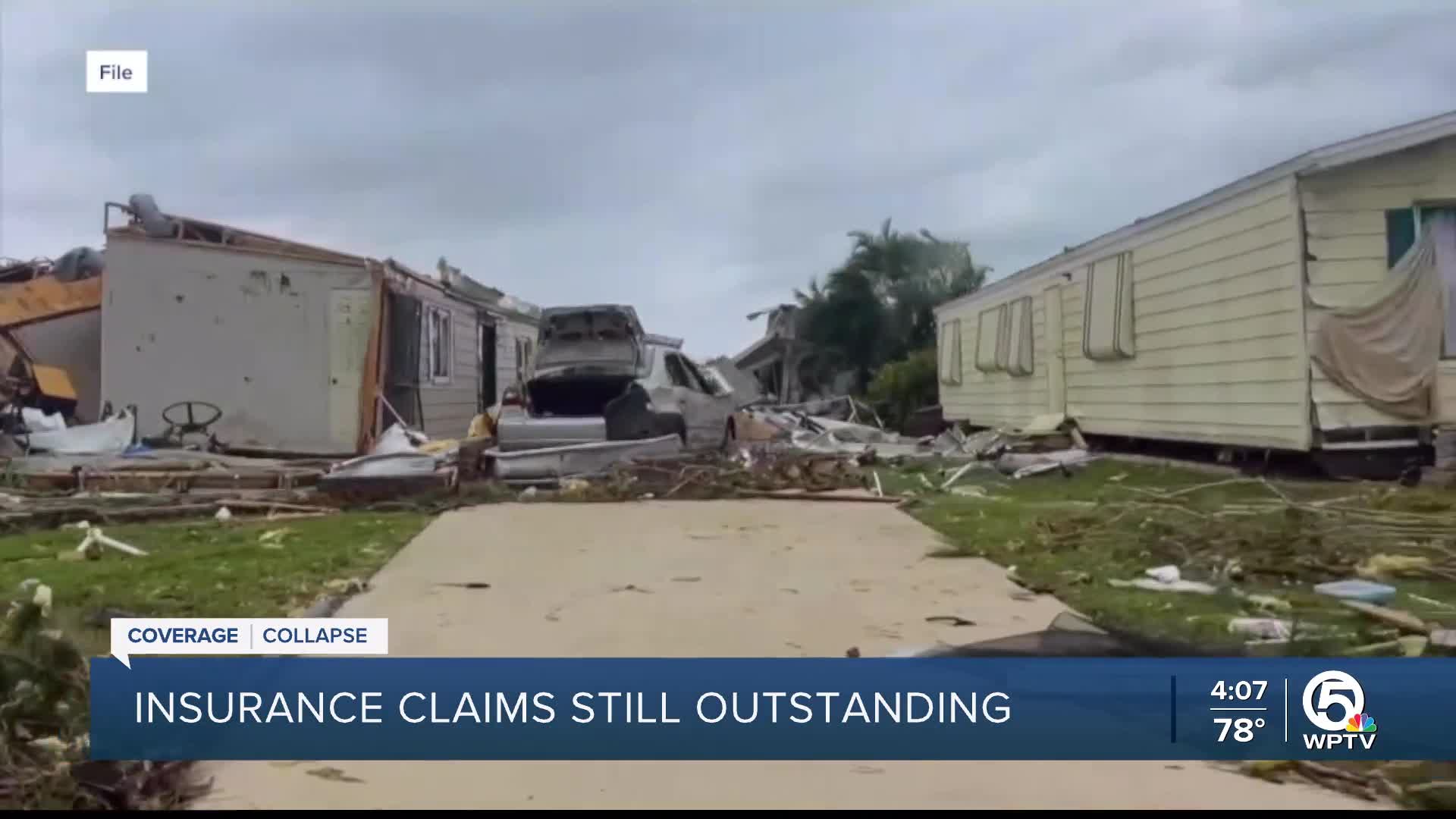

Citizens Insurance CEO Tim Cerio this month responded to the reports that the state insurer of last resort was closing claims without payment at high rate.

"These are really flood events," Cerio said recently at the Florida Chamber of Commerce's Insurance Summit in Orlando.

Cerio explained those flood events are not covered by Citizens policies but by flood insurance.

Real Estate News

Why a local firm was just subpoenaed concerning insurance

In the latest data Citizens has, Hurricane Milton resulted in 73,530 claims, so far, with 63,187 claims closed, 31,407 closed with a payment.

A deeper dive into the those Milton numbers also show 12,436 claims as being below the homeowners deductible and 4,036 were damages from flooding.

"Closed without a payment does not mean a claim is denied," Cerio said. "And in fact whether it's closed without a payment or even closed with a payment these claims are often reopened if more damage is discovered."

Citizens is also continuing its take out program to reduce policies, now under a million statewide.

The insurer is also still waiting on a decision from regulators to raise their rates for next year.

If you have a comment or question about insurance or are a Citizens policyholder, I'd like to hear from you. Email me at matt.sczesny@wptv.com.

Matt Sczesny is determined every day to help you find solutions in Florida's coverage collapse. If you have a question or comment on homeowners insurance, you can reach out to him any time.

Read WPTV's latest "Coverage Collapse" stories below:

-

9 ways shoppers are changing their grocery habits to save money

Years of grocery inflation have led many shoppers to change their shopping habits, from meal ingredients to brands.

TAX TALK: How would sales tax cut impact state budget?

The proposal from the Florida House Speaker to cut the state sales tax seems to be gaining fast support.

How Palm Beach County is protecting affordable housing units on future inventory

Affordable housing has been a big focus in Palm Beach County that WPTV has been digging into for months working to get answers.

Why chasing credit card rewards may not be worth it

More credit card holders are showing interest in gaining rewards from the cards even as interest rates remain high, according to a study from Bankrate.com.