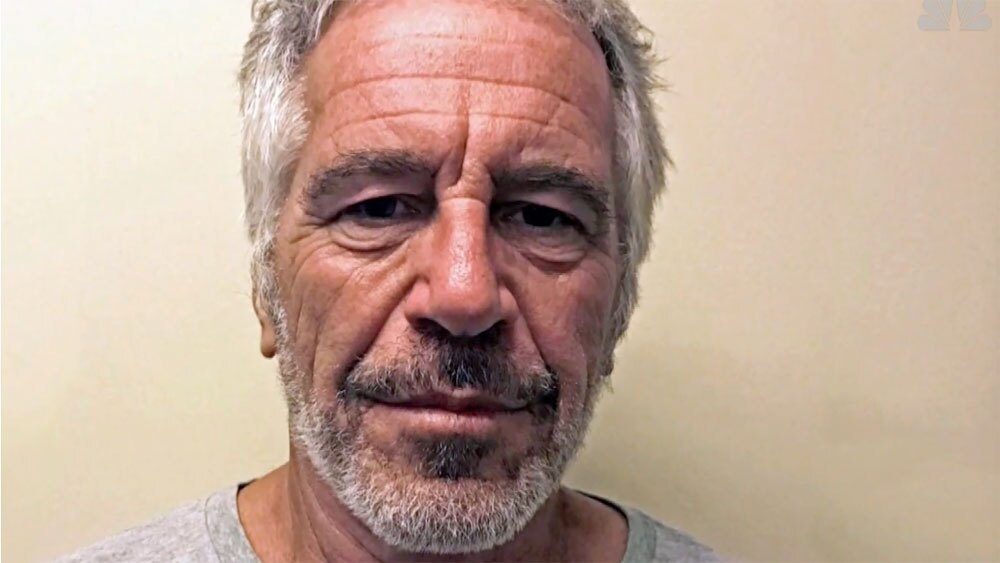

LONDON — Deutsche Bank has agreed to pay $75 million to settle a lawsuit claiming that the German lender should have seen evidence of sex trafficking by Jeffrey Epstein when he was a client, according to lawyers for women who say they were abused by the late financier.

A woman only identified as Jane Doe sued the bank in federal district court in New York and sought class-action status to represent other victims of Epstein. The lawsuit asserted that the bank knowingly benefited from Epstein's sex trafficking and "chose profit over following the law" to earn millions of dollars from the businessman.

One of the law firms representing women in the case, Edwards Pottinger, said he believed it is the largest sex trafficking settlement with a bank in U.S. history.

"The settlement will allow dozens of survivors of Jeffrey Epstein to finally attempt to restore their faith in our system knowing that all individuals and entities who facilitated Epstein's sex-trafficking operation will finally be held accountable," the firm said in a statement.

WATCH: WPTV's 'The Making of Filthy Rich: The Epstein Story'

Deutsche Bank would not comment on the settlement Thursday but noted a 2020 statement from the bank acknowledging its mistake in taking on Epstein as a client, said Frank Hartmann, the German lender's global head of media relations.

"The Bank has invested more than 4 billion euros ($4.3 billion) to bolster controls, processes and training, and hired more people to fight financial crime," Hartmann said in a written statement.

The Boies Schiller Flexner law firm, which also represents plaintiffs, called the settlement an important step for victims' rights.

"The scope and scale of Epstein's abuse, and the many years it continued in plain sight, could not have happened without the collaboration and support of many powerful individuals and institutions," David Boies, the firm's chairman, said in a statement.

Deutsche Bank had previously joined JPMorgan Chase, which is also facing a lawsuit over its ties to Epstein, in fighting the allegations. Epstein killed himself in prison while facing federal criminal charges of sexually abusing dozens of underage girls.

The German lender said late last year that it provided "routine banking services" to Epstein from 2013 to 2018 and that the lawsuit "does not come close to adequately alleging that Deutsche Bank ... was part of Epstein's criminal sex trafficking ring."

The lawsuits — which also target the government of the U.S. Virgin Islands, where Epstein had an estate — are drawing in some high-profile figures.

A U.S. judge decided last month that JPMorgan Chase CEO Jamie Dimon must face up to two days of questioning by lawyers handling the lawsuits.

The Virgin Islands government also is trying to subpoena billionaire Elon Musk as part of its own litigation against JPMorgan, accusing the banking giant of enabling Epstein's recruiters to pay victims and helping conceal his decades of sex abuse.

JPMorgan has denied the allegations and in turn has sued former executive Jes Staley, saying he hid Epstein's abuse and trafficking to keep the financier as a client. A lawyer for Staley had no comment on the lawsuit when it was filed in March.