DELRAY BEACH, Fla. — A new survey by bankrate.com found that 57% of Americans have been financially affected by an extreme weather event over the past decade, including a Delray Beach couple WPTV first spoke with in 2022 after Hurricane Ian.

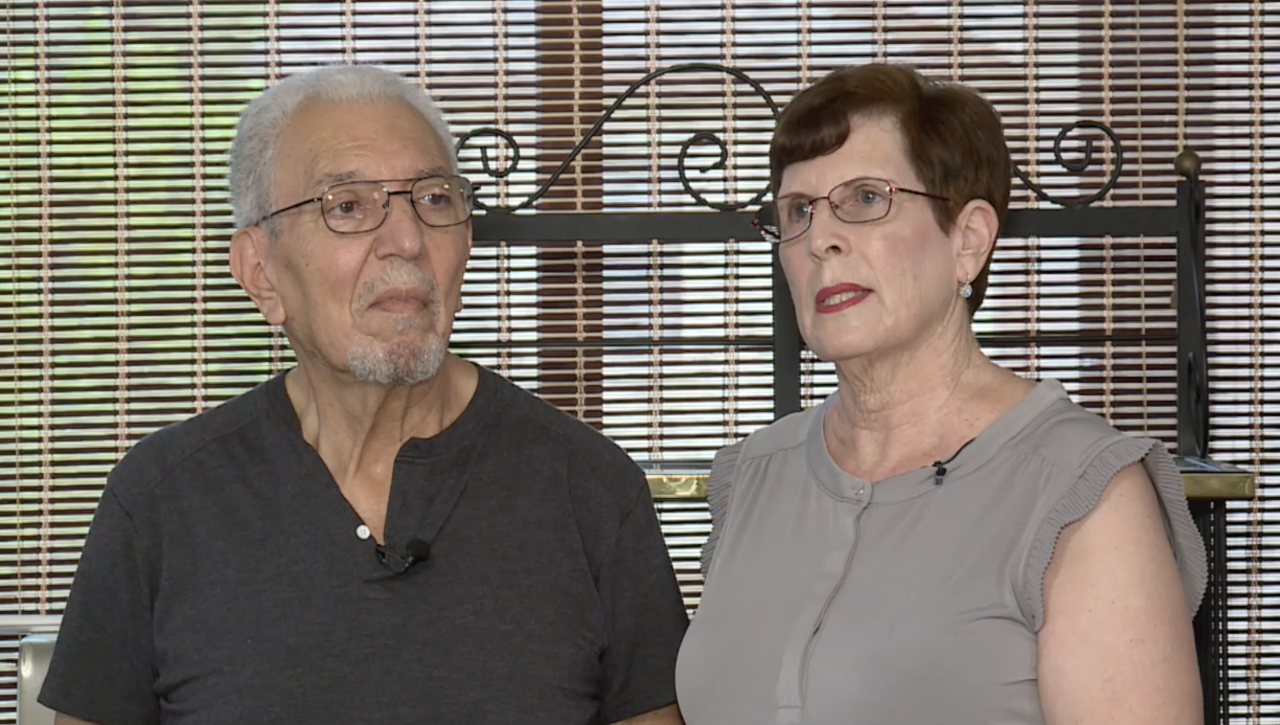

Last year, Marcia and David Hayot were forced to rebuild.

"It took about nine months to complete," Marcia Hayot told WPTV.

WPTV first met the Hayots at their Delray Beach home after they were hit by a tornado caused by Hurricane Ian last September.

"It just went 'shooosh.' It took 5 to 10 seconds. It had passed and did all the destruction," Marcia Hayot told WPTV last year.

The back half of the house and the roof were destroyed.

"With everything, furniture that we had to replace because we lost a lot of belongings, it was about $50,000," Marcia Hayot said.

The Hayots told WPTV they received about $17,000 in aid from FEMA but the rest was paid out of pocket because they don't have property insurance.

"We had stopped insurance because it had gotten prohibitively expensive and we just decided, let's put our own money aside," Marcia Hayot said. "If we need it, it'll be there for us and that's what we did."

According to a new survey by Bankrate.com, 57% of Americans have been financially impacted by an extreme weather event over the past decade and 57% of Americans also feel that trend will continue over the next 10 years.

"It's understandable that people are having trouble, struggling, to make their homeowners payments," Shannon Martin, a Bankrate analyst, told WPTV.

Martin said these days, that's causing homeowners to drop their insurance or at the very least, drop the extra coverage for wind and flood damage.

“We never want to see people drop coverage. We know they're having trouble securing coverage and things like that. Always see what else you can do," Martin said. "Talk to your agent about maybe increasing to a higher deductible. A lot of plans in Florida have a separate wind and hail that's a percentage of your dwelling."

For the Hayots, they told WPTV they'd rather continue to self-insure, because right now, it could cost them around $8,000 for property insurance each year.

"Can't afford it anymore," Marcia Hayot said.