TALLAHASSEE, Fla. — Child poverty could be drastically reduced if Floridians take advantage of the Child Tax Credit expansion. That's according to the Center on Budget and Policy Priorities.

The Florida Policy Institute highlighted the findings this week as the White House pushed the state and nation to check eligibility.

"An estimated 65.6 million American children will benefit from improvements to the CTC," the institute said in a statement. "Including roughly half of all Black and Latino children, whose families (along with other families of color) are disproportionately employed in low-wage jobs because of historic and ongoing discriminatory policies and practices."

Congress passed changes to the tax credit program earlier this year as part of the American Rescue Plan.

Starting July 15, eligible families can receive between $3,000 to $3,600 per child, depending on income and age. That's an up to $1,600 increase from the previous year.

For the first time, half the amount will then come in monthly payments through December. The other half will be a credit on next year's taxes.

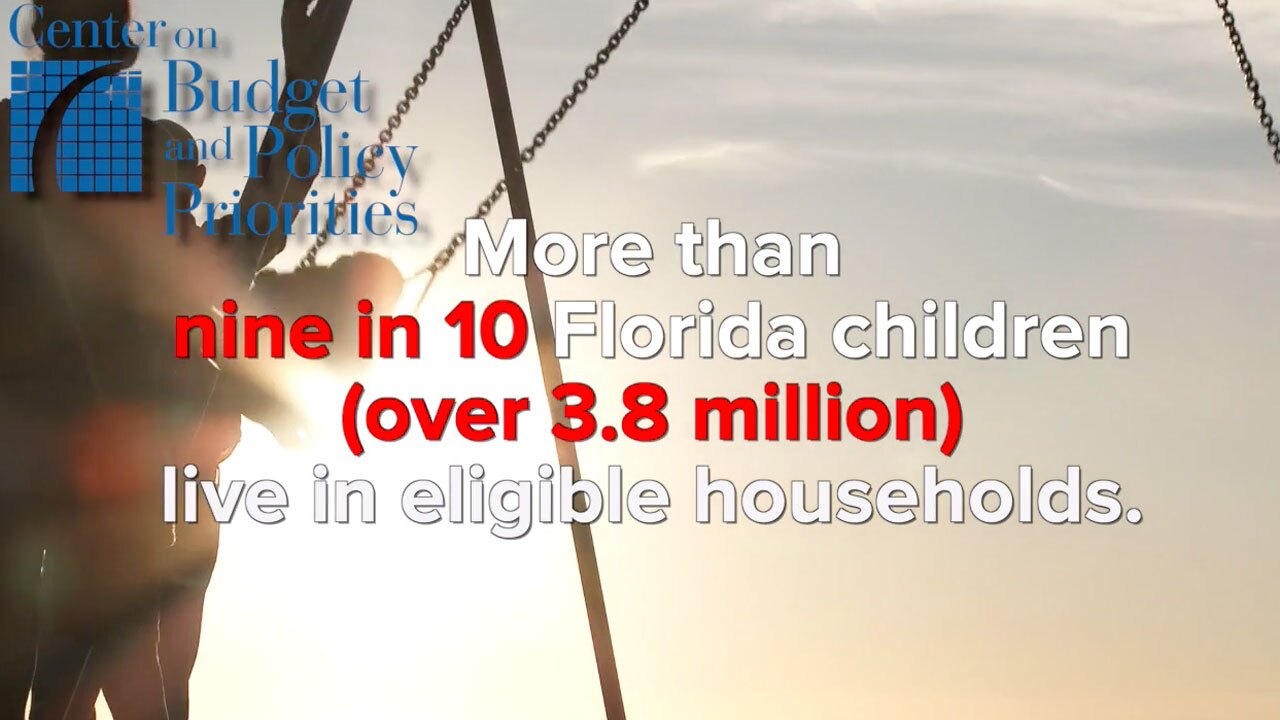

The CBPP estimated more than nine in 10 Florida children, over 3.8 million, live in eligible households. The group found residents could help reduce child poverty in Florida by 38% if they take full advantage.

"The [American Rescue] Act's changes will lift roughly 4.1 million children [nationally] above the poverty line -- cutting the number of children in poverty by more than 40 percent," the CBPP reported in May. "They also will lift about 1.1 million children above half the poverty line (referred to as "deep poverty"). Black and Latino children in particular, whom the prior credit disproportionately left out or left behind, will benefit."

White House Press Secretary Jen Psaki said most parents won't have to do anything to see their benefits.

"If they filed their taxes, they'll get this benefit automatically starting July 15," Psaki said. "But there are people who may not know they're eligible. We're encouraging them to go to childtaxcredit.gov to see if they're eligible."

Psaki said those who didn't file, which could be thousands in the state, are particularly at risk of missing out. Non-filers are often lower-income, who either lacked the money to pay or don't make enough to file in the first place.

"It’s going to help give people a little extra assistance," she said. "Maybe help more women go back into the workforce. It's going to help people get a little extra helping hand at this time as the economy is continuing to recover."

The American Rescue Plan saw party-line opposition from Republicans in Congress. Sen. Marco Rubio, R-Florida, took particular issue with changes to the Child Tax Credit.

"In the current pandemic relief bill under consideration, we would support increasing the Child Tax Credit to $3,500, and $4,500 for young children," Rubio said in a joint statement with Utah's Sen. Mike Lee. "However, we do not support turning the Child Tax Credit into what has been called a 'child allowance,' paid out as a universal basic income to all parents. That is not tax relief for working parents; it is welfare assistance."

Rubio went on to say lawmakers should expand the Child Tax Credit "without undercutting the responsibility of parents to work to provide for their families."